Energy EconomicsThe Energy Complex is complicated and affected by many factors including politics, weather, and economic conditions among others. It's a closed-loop system besides: energy markets reflexively affect these factors (politics and economics, at least). For reasons of both physics and logistics, most economies are highly dependent on carbon-based energy sources. Petroleum supply has become constrained within large regions of the world, with countries and regions becoming net importers or exporters. It is arguable that oil production peaked worldwide in the past decade, and US oil production demonstrably peaked during the 1970s. As regions have become dependent on each other as supplier or consumer, supply of energy is now a worldwide issue. We can't realistically discuss US energy/economic/climate policy, for example, without considering global interactions. In the US, politically-driven initiatives have been undertaken to shift energy sources and use to renewable sources such as wind and solar power. A specific objective of current legislation is to rapidly reduce use of carbon sources including petroleum, coal and natural gas. Over 80% of US energy use today comes from petroleum, coal and natural gas and it seems unlikely that such a shift is executable in the political timeframe. There is significant debate on whether this is even advisable given the economic effects. There might be realistic alternatives involving nuclear, natural gas, and evolution of coal, that are more realistic and have more acceptable economic consequences. However, these alternatives have not been organized into championed proposals at the national level.

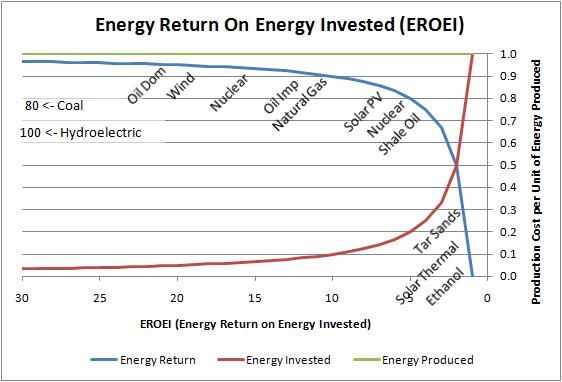

Current US public discussion on the topic of energy is driven around climate change and that case has been broadly and deeply argued. Sadly, the energy industry has been woefully inadequate and ineffective in representing to the public the state of energy supply and world competition and outlook. To the contrary, public perception is driven by incomplete information skewed to immediate-term, distorting the picture. Additionally, political interests further distort the information to their own advantage. As a result, overall public opinion more likely favors climate protection and resents big business entities that are portrayed as "polluters". Kind of a crab behavior. This is unfortunate, because both climate and sourcing are important to address. Note that most energy supplies in the world today are nationalized. Even the giant oil companies are actually small players in the overall scheme. In 2007, around the world government-controlled companies controlled 52% of production and 88% of proven reserves. >Energy Return on InvestmentEnergy Return on Energy Invested is explored by David Murphy of SUNY, who provides estimates of EROEI for many energy sources. (as well).

These EROEIs do not include inefficiencies due to thermodynamics, inversion, or use; but do include costs for production, refining, and transport or transmission as required per source. These are energy return on investment, not cost return on investment. However, cost return on investment is partially a function of EROEI of the energy source. (14 Apr 2009) Discussion by Charles Hall, State University of New York College of Environmental Science and Forestry, on provisional assessment of EROEI for many energy sources. The article observes continued decline of EROEI within and across sources, and discusses minimum EROEI needed for industrialized economies. One conclusion is that few alternative energy sources have the EROEI necessary to act in a meaningful way as replacement fuels for oil and gas without significant cost reduction. (Note that this article links to several other articles also on the subject of EROEI or Net Energy.) An update to the paper "What is the Minimum EROI that a Sustainable Society Must Have?", discussed here, concludes that for a system to survive it must realize minimum EROEI of 3:1. Fuels providing EROEI less than that, must be subsidized by fuels yielding greater EROEI. (Note that there are multiple "ROI" metrics around energy economics (return on energy, return on investment et al.), and that their acronyms are frequently interchanged in literature. Dr. Hall's paper uses the acronym "EROI" to refer to the metric referred to as EROEI elsewhere on this website.) Specific points made in the paper include:

CRS Report for Congress, Power Plants: Characteristics and Costs by Stan Kaplan provides more in-depth financial analysis of power generation by primary and alternative fuels. The report provides a "base case", to which it then applies various government financial variations and carbon control costs. The base case illustrates intrinsic costs of power generation and roughly supports the EROEI figure above. Comparison of fuels, base case (from Table 4, page CRS-39): (6 Apr 2010) Further information on electricity generation cost from EIA Electricity page, and EIA Electricity Market Module. (30 Dec 2010) An article Renewable and fossil electricity generation costs compared, at The Oil Drum.

|

|||||||||||||||||||||||||||||||||||||||||

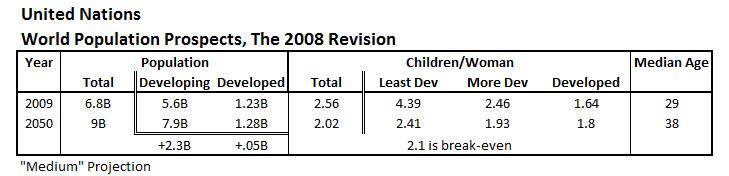

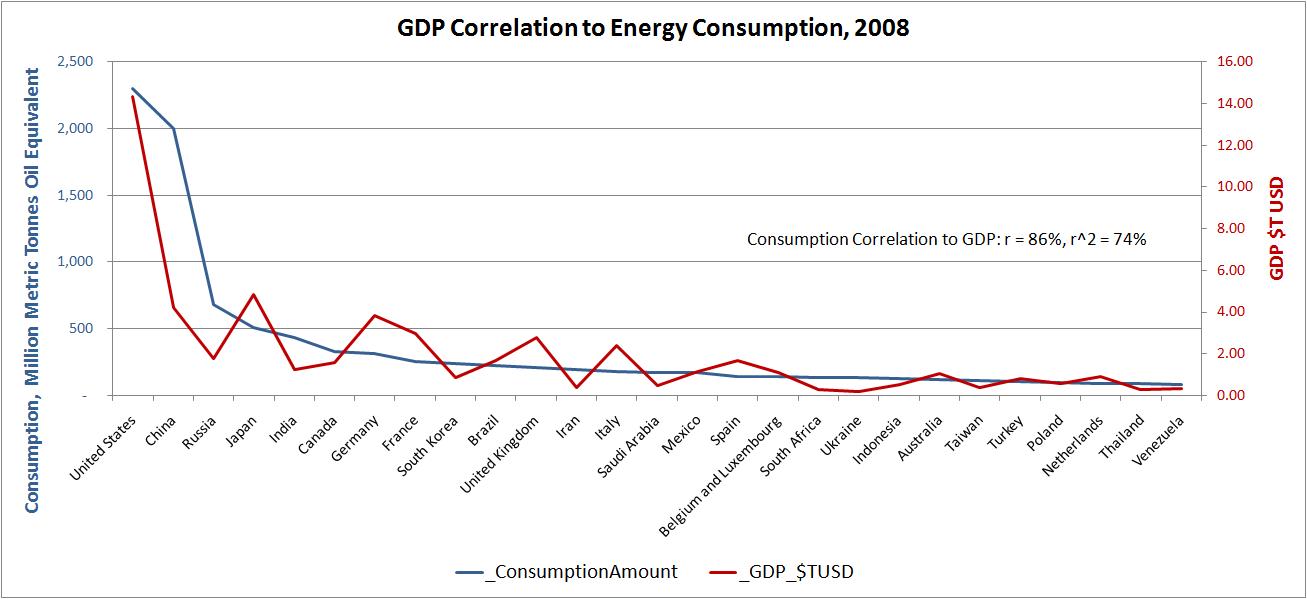

Some Basic Economics(6 Apr 2010) There are of course zillions (technical economic term) of sources on economic theory and many readers of this site are already familiar with the topic. Nevertheless, here is a timely article at Seeking Alpha by John Mauldin, that describes the connections among nominal gross domestic product, money supply, and velocity of money. The article is timely in that it connects these to the observed economics of the crisis we are experiencing in 2009/2010. A quick summary of theory (with some interpretation to map to this site). First, by the Quantity Theory of Money, PQ = MV, meaning that nominal gross domestic product (sum value of all national transactions (transaction prices P * transaction costs Q)) = money supply times velocity of money (which is number of times per period that a given unit of money is spent). Financial "innovation", in the form of CDOs etc., leading up to 2009 increased spending rate V although money supply M during that time was falling, ultimately leading to a crisis in credit. We are now experiencing the unwind of those innovations, and V has declined significantly driven in part by the initial panic. To maintain P, the governments have pumped large amounts of money M in the economies - so as a result, GDP has experienced limited decline. And of course governments accomplish infusion of money by spending to further their agendas (for example, redistributing wealth), hence driving political disruption. As a result, corporations now have large amounts of money on hand. At lower employment rates, this increases productivity and debt-to-equity metrics, driving up equity markets and ultimately leading to increased investment in capital. At that point the Fed will have to take money out of the system by raising rates, to avert inflation. The intent is that all this will lead to economic recovery. But this remains balance-sheet recovery driven by monetary policy, rather than recovery in actual production of goods. Significant production capacity remains idle, lending rates remain low (V), and housing inventory remains high. Disagreement, expressed in political positions, remains on economic recovery via balance-sheet repair, versus production recovery. Energy Usage, GDP, and EfficiencyGDP (Gross Domestic Product) is the sum of the value of final market goods and services for domestic consumption plus gross investment plus government spending plus the net of trade, exports minus imports. As such, it is something of a measure of economic performance. It is not a perfect measure, but it is commonly available and is tracked and updated frequently using commonly accepted definitions so it is generally comparable. A probably large effect is that GDP does not include subsistence production, i.e. goods produced for immediate consumption without involving any form of trade, domestic or regional. (Credit: /r/dataisbeautiful blacktiger226) The animation above compares GDP of countries over time ranked from largest to smallest, giving an interesting comparison of relative and fluctuating economies. In particular, during the timeframe shown the largest GDP is the USA. Given the economics of the period around 2018 it is interesting to note the rise of the GDP of China in comparison to the USA. The GDPs of the European countries are compared also in this way among each other. It would have been instructive if there were included a GDP aggregating the EU member states which would then portray the EU as an economy comparable to the USA and to China. The animation gives the impression of the US massively dominating world economics which is part of the story, but it is also fair to point out that the EU countries participate in a joint economy with mutually-related import/export, trade, and taxation policies. The GDP of the EU is a little larger than the US and that comparison animated along with the the GDP of China would have left a truer impression of worldwide relative economics over time. From the point of view of this website, GDP provides a good first-order metric useful for comparison of economies. Its shortcomings in these comparisons are that GDP does not reflect differences in taxation, or in unemployment which are important to individual and business well-being. Consequently, per-capita GDP is more a measure of economic productivity of an economy, than it is a measure of average take-home pay. Relationship between energy consumption and GDP.

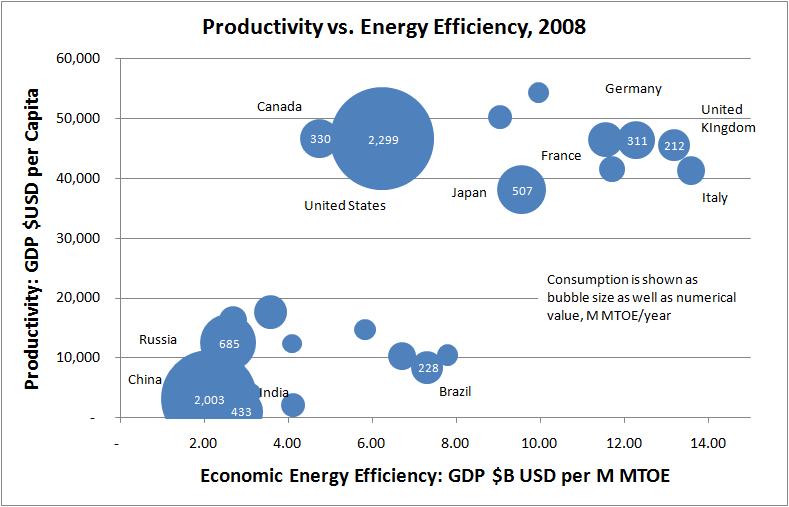

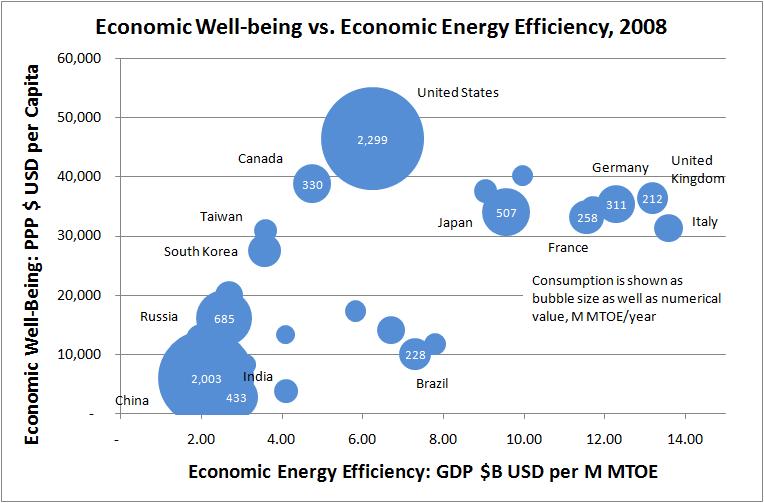

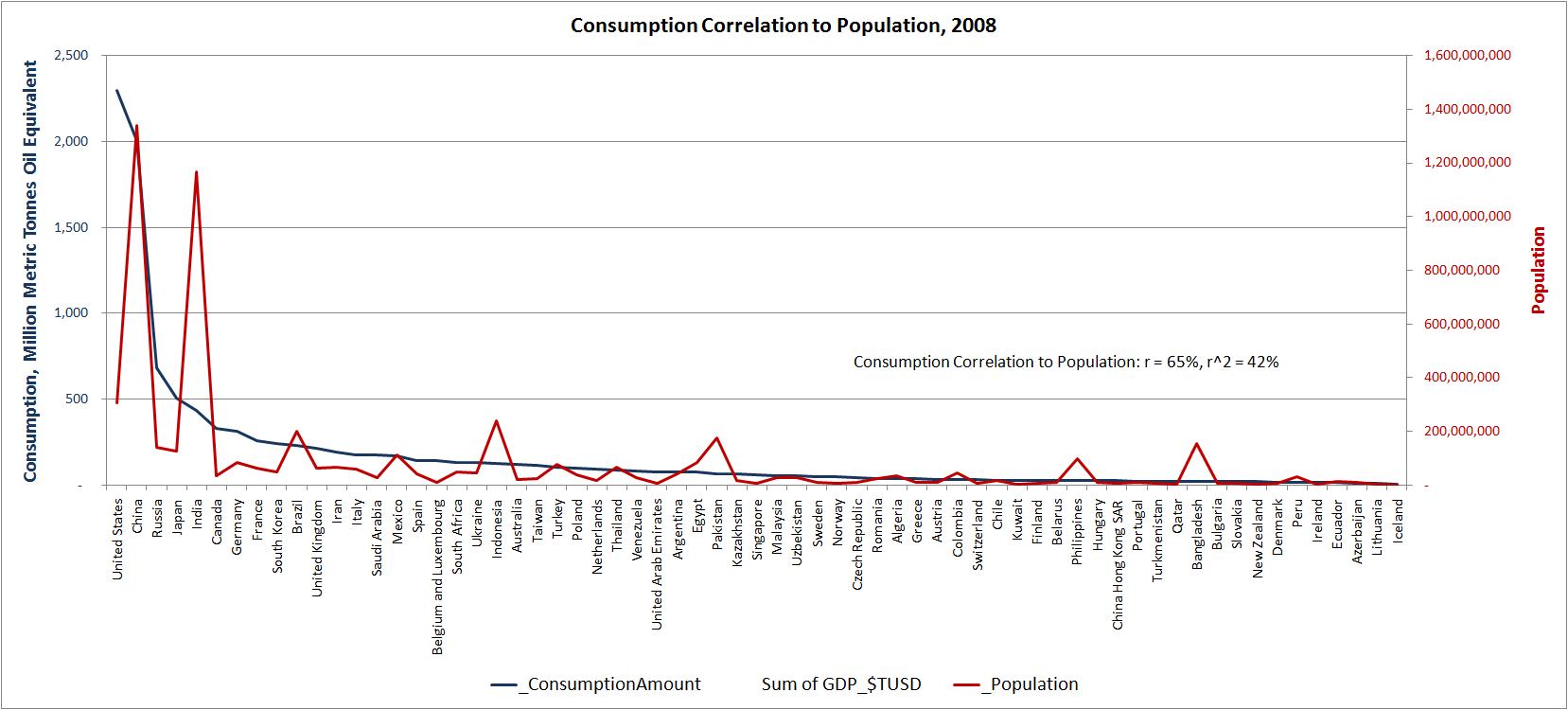

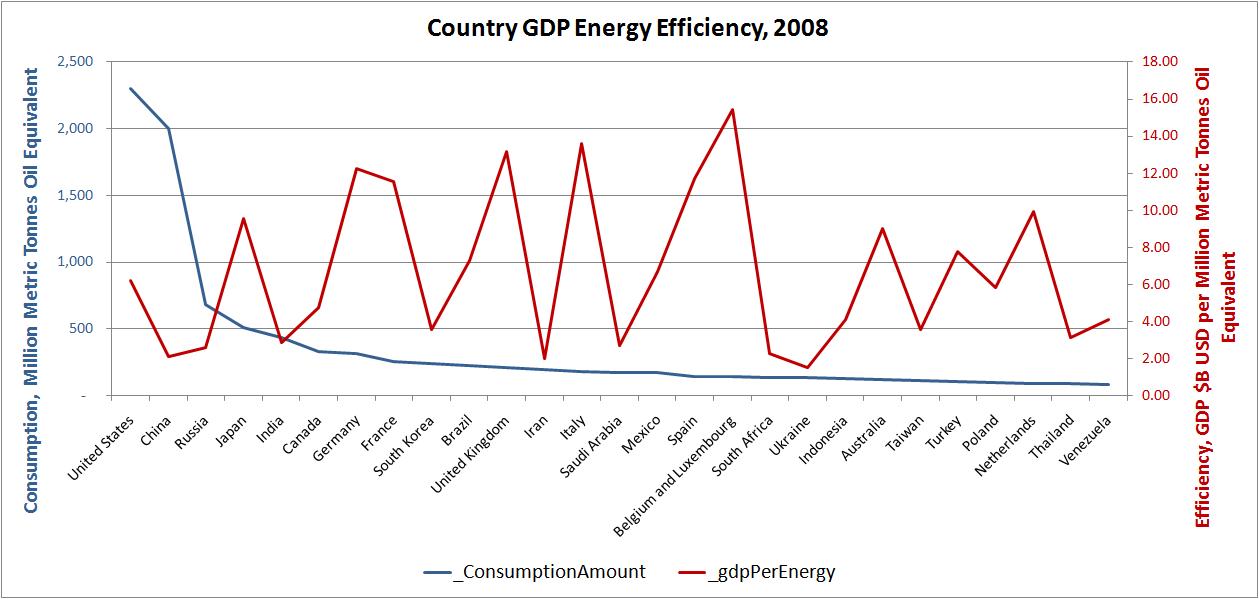

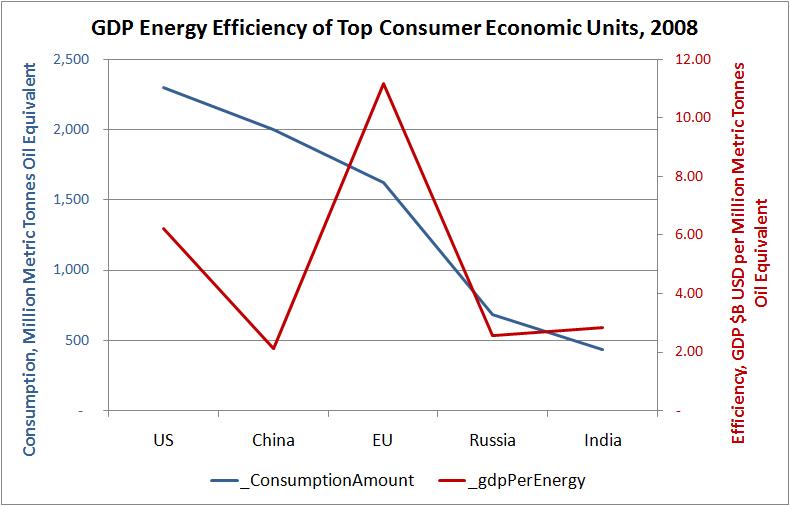

Energy consumption shows r=86%, r2=74% correlation to GDP, with significant variation by country among the largest consumers. Consumption correlates r=65%, r2=42% to population.  Variation may result from proportion of the economy related to subsistence farming, heavy vs. light industry, transport distances, military, and waste. Greater import of finished goods will make an economy appear more energy-efficient, and greater fabrication of goods from raw materials and energy will make an economy appear less energy-efficient. The following charts display 2008 energy usage of the top world energy consumers, with highest consumption at left (US and China) and sorted to declining consumption to the right. Only users of more than 100M MTOE are shown. Efficiency, measured in GDP produced per energy consumption, is superimposed in red.  GDP is taken from the CIA World Factbook, and energy consumption is taken from the same BP data as on other pages on this site. More data is available from the EIA. Efficiency varies among countries by as much as 500%. A clear trend is that EU countries are consistently the most energy-efficient. Efficiency of use has highest leverage among the highest users, to the left of the chart. There's a lot of dialogue on energy consumption (actually on carbon footprint), that involves the US, China, and India. The following chart includes those regions, as well as the EU as comparison to an industrialized economy of similar size to the US.  The EU efficiency trend shows up in this chart as well. The US is about half as efficient as the EU, and China is about 1/3 as efficient as the US. India's consumption is far less than the others shown.

Taxes and IncentivesArtificial economic considerations such as subsidies, tax treatment, and even profit margin will distort the picture. In the end, thermodynamics will prevail independently of these economic considerations. The effect of these distortions will really be to burn one form of energy to produce another form; if the target form is less efficient then energy is wasted and cost to the economic system is increased. Competing economic systems compete on many fronts, and this will be another one that will increase or decrease relative advantages.

To be profitable, cash flow from an energy source must include operating costs, capital and depreciation costs, overhead; and return based on average grid cost over the time energy is provided to the grid. Normal business taxes must be included, but subsidies should not be included to determine true profitability or break-even. Artificial considerations may well be needed to develop economies of scale, and to encourage R&D in an otherwise un-profitable market. We should however insist that break-even should be visible and moving toward us in time. (22 June 2010) Both fossil fuels and renewable sources receive government subsidies in one form or another. It is sometimes pointed out that the total dollar amount of subsidies to fossil sources is much larger than the total subsidies to alternative energy providers. However... this misses out the point that fossil sources provide many times more energy today than do alternative sources. The proper comparison would be subsidy dollars per MWh. Using this metric, the US EIA reports the following subsidies per KWh:

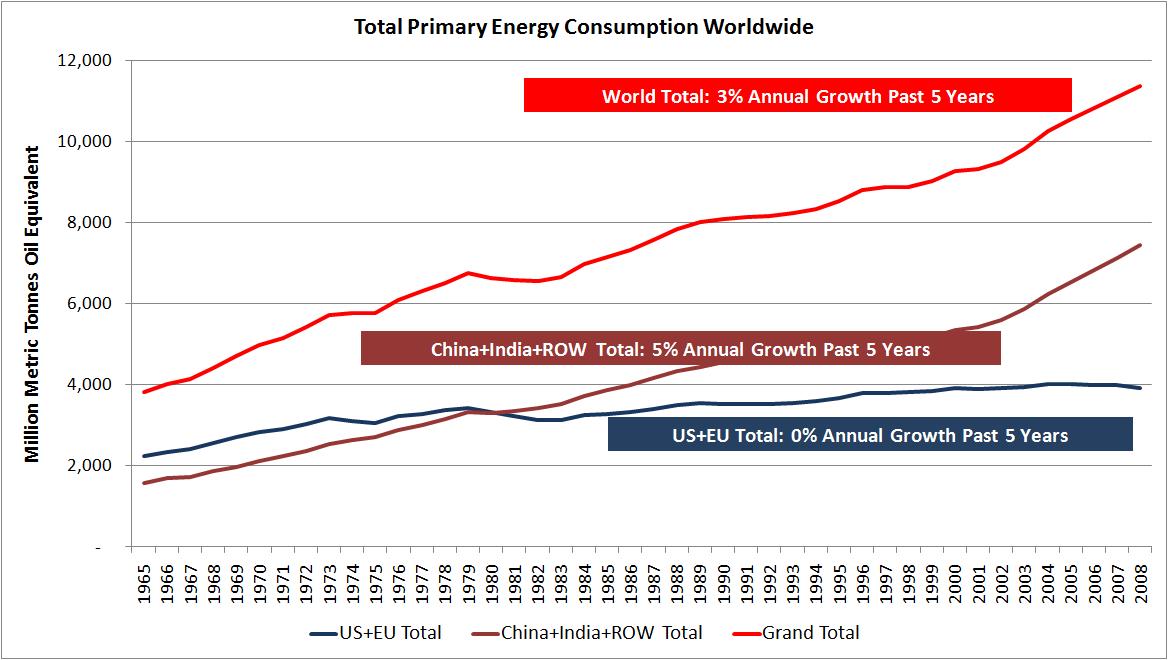

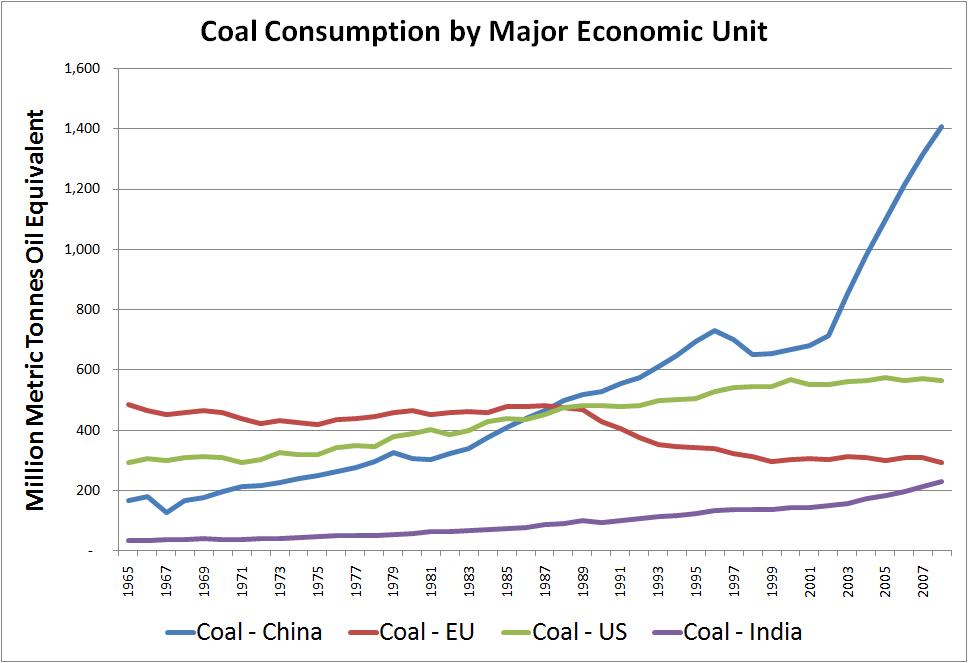

Energy Information Administration, Federal Financial Interventions and Subsidies in Energy Markets 2007, SR/CNEAF/2008-1 (Washington, DC, 2008) Cap and TradeRecall that China today uses nearly as much total energy as the US. Coal use is large and growing fast, whereas oil and natural gas use in China is growing at a much lesser rate. US total energy usage including coal has grown at a slow to slightly down rate over the past decade. So magnitude and growth of coal use is the dominating factor although similar arguments do apply to all sources.  The chart illustrates that Cap and Trade implemented by the US as a measure intended to control CO2 emissions, would have very limited effect given the magnitude and growth of coal use by China. Coal is used to generate 50% of US electricity. It's unlikely that wind and solar will be able to replace coal at this magnitude of use for years, likely over a period of a couple of decades. Cap and Trade would increase energy cost during that period, a cost absorbed by the users of electricity both directly and through derived products. Users actually drive demand. Furthermore, wind and solar replacing coal use currently cost more than coal per BTU generated. (Tax subsidies have to be ignored for national consideration, because those costs are paid by economic activity elsewhere in the economic system and it's a zero-sum game. The gamble is that those economics will improve over time and with volume of deployment.) So energy produced by coal use that is not replaced will cost more, and energy produced by coal use that is replaced will also cost more. The result is that the amount of the Cap and Trade tax on energy, plus any incremental cost of energy, will simply deduct from GDP. Net, the GDP of the US will be negatively affected, while CO2 accelerates anyway due to coal use in China. It's frequently stated that Cap and Trade will increase your energy bill. That understates the effects. Energy costs pervade of all goods and services in human endeavor. So increased energy cost, for virtually all forms of energy, will penetrate all goods and services raising overall cost of living and cost of business. This includes direct and passed-through cost increases to gasoline, shipping, travel, heating, chemicals, fertilizer, food, construction... everything. It's also frequently pointed out that some energy companies themselves have endorsed Cap and Trade. Read those companies' statements carefully... they see Cap and Trade as the less onerous path than EPA regulation. Still will cause GDP loss, employment loss, and higher prices for everything. Even a carbon tax that is ostensibly neutral (taxing a deprecated commodity, and rebating back the tax collected, to a preferred commodity) has the undesirable side effect of increasing net cost. The deprecated commodity is typically lower cost per BTU (e.g., coal) and the preferred commodity higher cost per BTU (e.g., solar PV) and the intended effect of the tax is to shift usage from the deprecated commodity toward the preferred. By this method of tax shifting, the after-rebate cost per BTU of the preferred commodity can be made less than or the same as the after-tax cost per BTU of the deprecated commodity - but that will be at higher cost than the pre-tax cost of the deprecated commodity. The average cost per BTU is increased. Taxes shift but don't create money, so this is inevitably more expensive in total.

To quantify: Using Pp to represent price per BTU of the preferred commodity; Pd as price per BTU of the deprecated commodity; and T as the tax applied to the deprecated commodity and rebated to the preferred commodity, simple algebra shows the tax rate needed for equal price per BTU between the preferred and deprecated commodity: For example if Pp = 2*Pd then T = 50% tax rate, or BTU cost of 150% of the deprecated commodity pre-tax BTU price. Additionally, resulting demand for each commodity does not remain static, and as demand for the deprecated but lower-cost commodity diminishes, less carbon tax is collected against it so there is less tax to credit against the higher-cost commodity of which more is used. A new equilibrium point is ultimately established, at further increased total cost. A way to avoid this is for the preferred commodity real, pre-rebate price to decline to a level near the real, pre-tax price of the deprecated commodity. This is a healthy challenge for renewable energy sources. The other way to avoid this is to use net less energy. But since energy use is fairly closely correlated with GDP, there are undoubtedly unintended effects that are difficult to predict. This result likely includes decreased GDP, resulting in long-term unemployment and economic instability - unlikely to be tolerated by the population. Here's a discussion of the cost, both the article and the comments.Chicago Climate Futures Exchange (CCFE). Overview of futures products. Current market quotes. Climategate(Nov 2009) Much about cap and trade and carbon tax is motivated by Anthropogenic Global Warming (AGW aka GW aka Climate Change). This is widely and broadly discussed and much worldwide government policy is already built around this, affecting trillions of dollars. In late 2009, however, some scandal has occurred around the scientific method used among primary researchers who have provided the foundational data and analysis. It is not the purpose of this site to get into that argument (other than to point out that economic energy availability is likely a more imminent problem and to discuss how that will play out).

The principal pro-AGW website is RealClimate. With countering views, Climate Audit and Watts Up With That are principal sites critical to AGW. The scientific controversy goes back over a decade; disclosure of some research practices was recently disclosed (Nov 2009) and has led to the scandal. AGW has been projected from statistical analysis, complex curve fitting and trend determination from multiple data sets of fuzzy data (multiple in order to span an extended time period). The datasets have not been disclosed (disclosure is established practice in other scientific research), some are lost, and that which has been seen is questioned in terms of calibration among the data sets, and adequacy in size, timeframes, and integrity. Statistical interpretation has been the method of projection. Specific analysis programs, data filtering, trend analysis and curve fitting have not been disclosed, but what has been seen and analyzed has led to questions on the methods used. As source code for analysis programs has become available for review, conclusions have been increasingly called into question. Review of the data and methods has been held to a closed set of climatologists justified as the only set with expertise to peer-review. However, there are many in the scientific community with expertise in scientific statistical methods who would be capable of reviewing the technical methods and data adequacy. Scientific Method does not depend on consensus; just the opposite, it relies on solid explanation of aberrant data points. Galileo would have been an outsider to accepted science in 1633. The connection between the science and politics is also called into question. It remains to be seen how the scientific discussion will play out, and how political response will develop. (19 Aug 2010) A paper by McShane and Wyner submitted and scheduled for publication in the upcoming issue of the peer-reviewed journal Annals of Applied Statistics, analyzes the proxy data reconstruction and predictive methods used by global warming models. The article concludes that the data consists of too small a sampling of truly independent observations and is not sufficient to detect a sharp increase in temperature. Further, they state that climate scientists have under-estimated uncertainty of proxy-based data reconstructions and have been over-confident in predictive capabilities of their models. Such a paper does not go lightly into the sphere of AGW discussion, and is widely discussed in the blogosphere. Here is a starting point. This subject, above all others, is connected to politics and in fact permeates discussion and practice on all topics on use and sourcing of energy. AGW advocates correlate to politically-progressive/statist government policies, and skeptics correlate to conservative limited-government policies. AGW policy advocates saving the world from imminent disaster through mitigation measures of extreme negative consequence to industrialized economies and populations, and demands payment for carbon reparations, social justice, economic justice, environmental justice, third-world development and the like. Advocacy discussion frequently leads to dismissiveness, ad-hominem argument, and invective. The scandal shows examples of how this has bled into the science as well. Skeptics generally identify analytical weaknesses that cast doubt on AGW advocacy predictions, and drives for open review and analysis. Open Source practices have been identified as more likely to produce a broadly credible result than government agency review. Measures identified by skeptics tend toward adaptation, rather than mitigation of an effect considered doubtful, given the enormous costs and effects of proposed mitigation methods.

At the very least, Climategate will result in re-examination of AGW/Climate Change science, gating the continued and projected huge mitigation expenditures. And since the raw data was disposed of by the primary researchers, this will be a protracted, multi-year process. During this time and thereafter, it is likely that economic necessities will overturn assumed limitations to energy use and sourcing driven previously by implemented responses to Climate Change logic. It remains likely, as discussed elsewhere on this page, that oil supply will become increasingly contested and that oil price will inexorably increase, pressuring transportation and agriculture. Alleviation of transportation cost issues will drive back to affect other energy sources, and is likely to lead ultimately to increased demand for electricity for EVs. A net effect of Climategate will be to more freely enable use of coal for electrical power generation. Nuclear power restrictions are not so connected to Climate Change and so remain unaffected; so use of coal to generate electricity will gain relative advantage. Coal is the cheapest source of electrical power, so this will in turn put pressure back on cost requirements for wind and solar-generated electricity, slowing broad deployment. The position of this site is that regardless of AGW, energy supply is likely to be an increasingly important and visible issue, and the purpose of this site is to discuss how this will manifest, and reactions to it. Let's not lose the importance of this topic in the scuffle over the AGW controversy.

Site Focus:

|

|||||||||||||||||||||||||||||||||||||||||

A variant of this argument states that the US produces more carbon per capita than any other country. Both

A variant of this argument states that the US produces more carbon per capita than any other country. Both